Decrease in Payables Cash Flow

A decrease in accounts payable occurs when a business makes a payment to its creditors for its outstanding balance. Increase in Account Payable 35000.

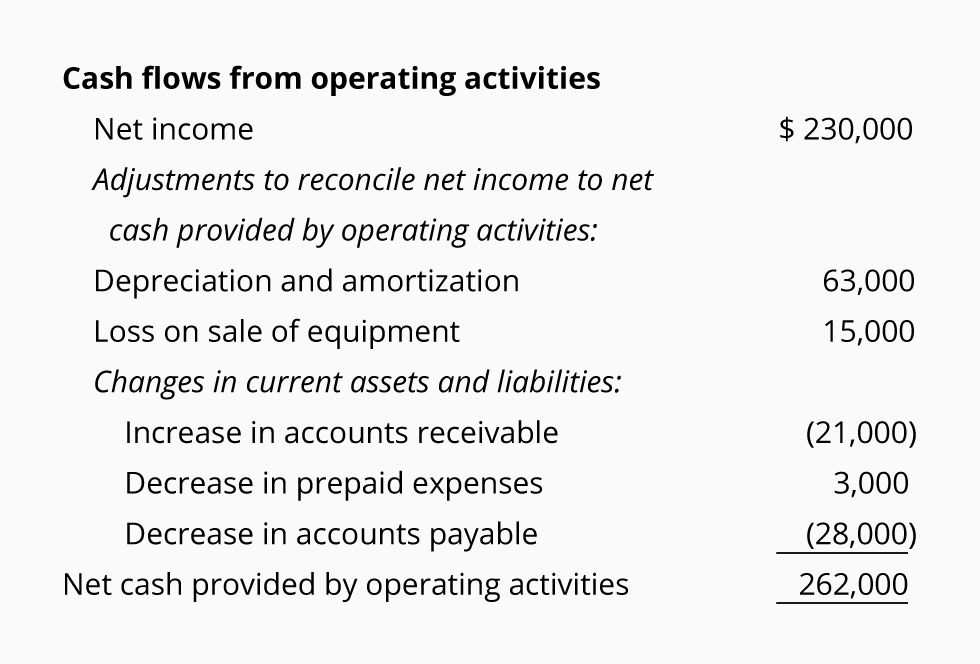

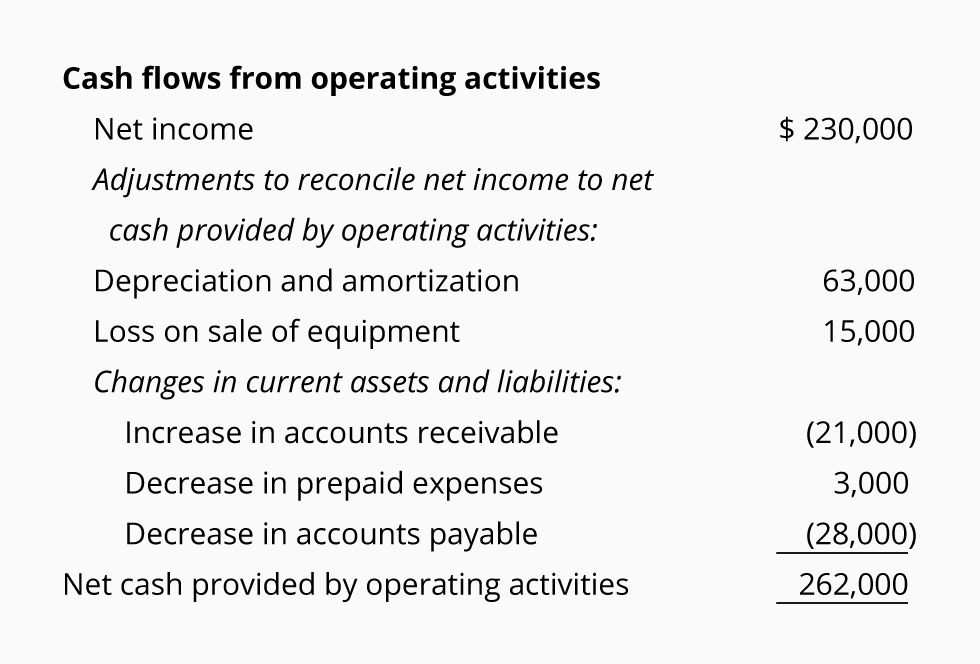

Cash Flow Statement Explanation Accountingcoach

A company records payments made towards the loan principal as cash outflow in the financing activities section of the cash flow statement decreasing its total cash flow.

. However cash flow would be reduced by inventory purchases. Cash flow statement Cash flow statement is one of the financial statements that reports the cash. Expressed differently the revenues of 20000 minus the 14100 of cash paid for expenses 15000 minus the 900 of expenses not yet paid means an increase in cash of 5900.

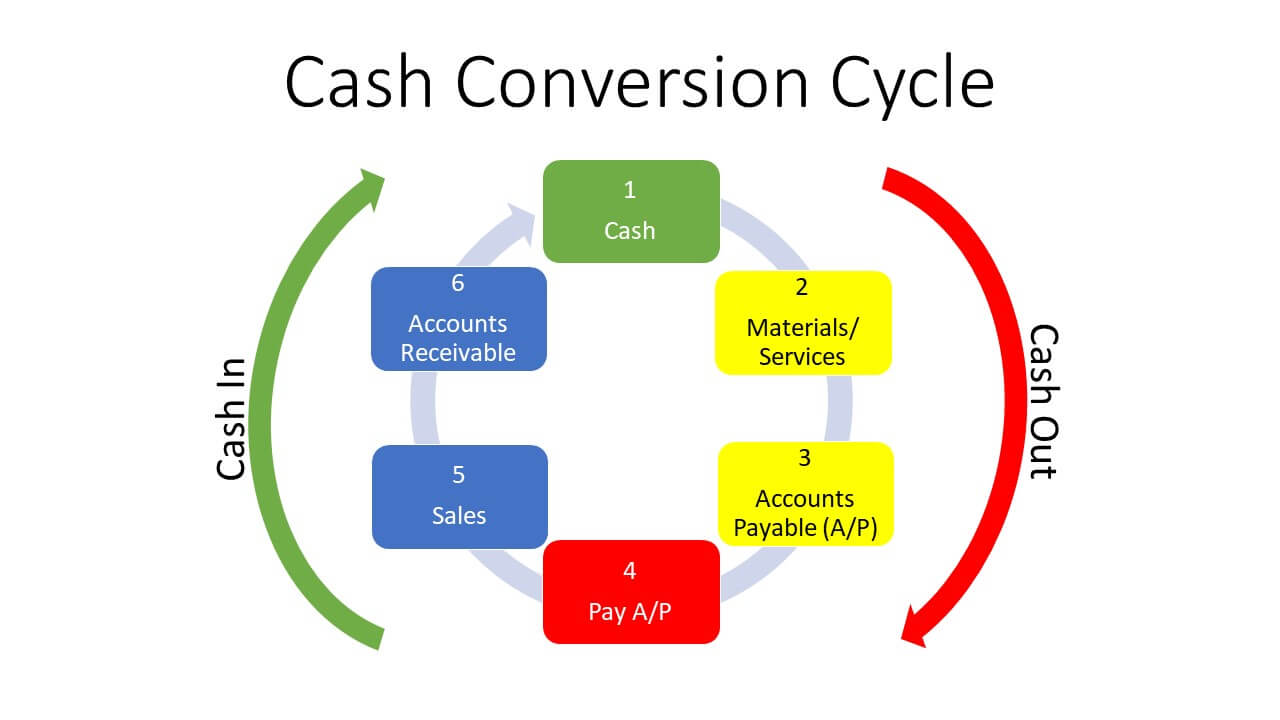

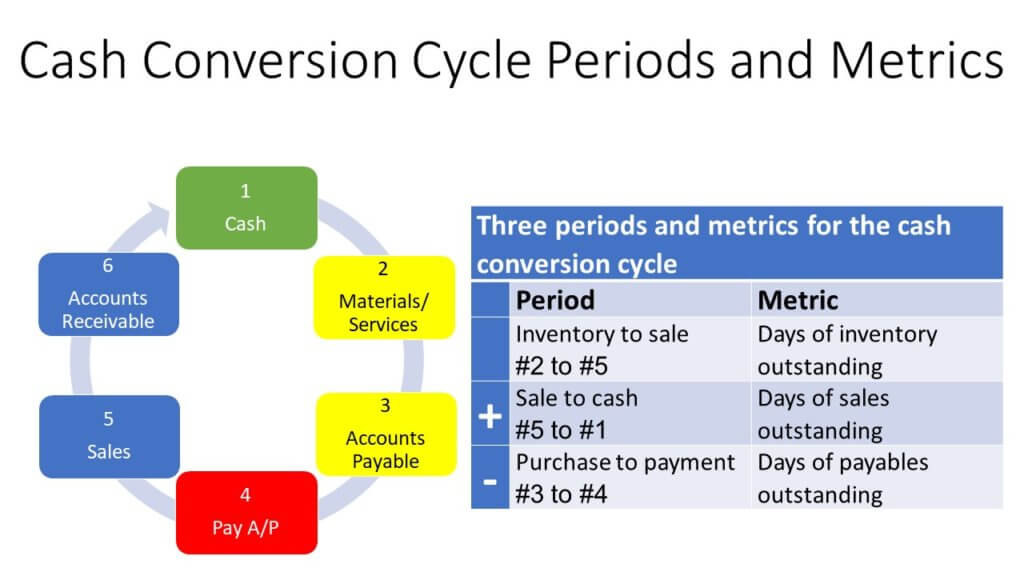

A decrease in trade payables occurs when cash paid to suppliers is greater than cash and credit purchases. While increase in current assets and decrease in current liabilities are deducted from. If you find a decrease in the days payable outstanding your.

When the INDIRECT METHOD of Cash Flow is used decrease in Accounts Payable is a deduction adjustment to the NET INCOME. We can see current. This will decrease the accounts payable for the company.

Under Indirect method we add back the decrease in current assets and increase in current liabilities. The basic calculation is subtracting ending. Below is Exxon Mobils XOM balance sheet from the companys 10K statement for 2017.

Decrease in trade payables. So it means that there are net amount credit sales for which we have not received any cash amount. Up to 10 cash back If you were able to extend your average payable period from 20 days to 30 days adding those 10 extra days defers 3000 in cash outflows.

Companies need to calculate the increase of decrease in accounts payable prior to including it on the statement of cash flows. The opposite holds true for a decrease in accounts payable. A decrease in accounts payable represents that cash has actually been paid to vendorssuppliers.

To calculate it multiply the days in the period by the ratio of accounts payable to the cost of revenues within the same period. Net cash flow from operating activities Net cash flow from investing activities Net. Decrease in accounts payable decreases cash flow use Increase in long term from BUS 310 at Seneca College.

Negative cash flow can be caused by a decrease in accounts payable or an increase in accounts receivable. Settlement of short-term credit with suppliers and vendors decreases the. These two factors can both cause negative cash flow because.

So we will subtract it under the Operating. Decrease in the Accounts payable balance means that the. In the cash flow statement above we calculate the net increase or decrease in cash flow as follows.

The larger cash payments have been. This means that the decrease in accounts payable has a negative effect on cash flows. When the cash is paid accounts payable is debited hence reduced while cash is credited hence reduced from the bank or.

The Short Cash Cycle How To Cut Crunches And Grab More Growth

Understanding Cash Flow Statement Finance Train

Statement Of Cash Flows Indirect Method Change In Accounts Payable Youtube

The Short Cash Cycle How To Cut Crunches And Grab More Growth

0 Response to "Decrease in Payables Cash Flow"

Post a Comment